Best mortgage calculator with extra payments

Here are the advantages of making extra mortgage payments. Assess any money that you can foresee needing in the future college tuition a vacation a newused car home repairs.

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

How much extra payment should I make each month to pay off.

. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. Ultimately significant principal reduction cuts years off your mortgage term. The amount of interest youll pay over your loan repayment term.

The total dollar amount youll spend for all the expenses included in your. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Extra Payment Mortgage Calculator.

To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. Consider how long you plan on living in the home. By making additional monthly payments you will be able to repay your loan much more quickly.

Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes. It is easier to match your largest expense mortgage payment to your income when the payment period matches your pay period. The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase.

Then our free mortgage calculator will give precise data about monthly principal interest a number of total payments the total interest that you need to pay and payout date. It can be a good option for those wanting to contribute more money toward a. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

Our calculator includes amoritization tables bi-weekly savings. The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete amortization schedules. Bi-weekly mortgage payments work best when you are paid every other week and your income is high enough to support the payment.

When you have a mortgage at some point you may decide to try and pay it off early. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. What the mortgage calculator shows you Your monthly payment will be section.

The calculator lets you find out how your monthly. Four alternatives to paying extra mortgage principal. How to Use the Mortgage Calculator.

Check out the webs best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Using our mortgage rate calculator with PMI taxes and insurance.

Before you begin making extra principal payments on your mortgage its best to consider your overall financial goals. Fill out the other important data taxes start date PMI etc only if they are different then the default data in the mortgage payment calculator and hit enter. To find the best mortgage rates we analyzed all 30-year loans from the biggest lenders in 2021 the most recent data available.

Pay this Extra Amount. With regular monthly payments your mortgage balance is paid down at a slow pace. Extra payments count even after 5 or 7 years into the loan term.

Reduce Your Mortgage Balance Faster. See how those payments break down over your loan term with our amortization calculator. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. If the first few years have passed its still better to keep making extra payments. September 16 2022 Monthly mortgage payments.

Another technique is to make mortgage payments every two weeks. 12 The companies with the lowest mortgage rates on average are. Total of all payments.

Mortgage Amount or current balance. It would take years before the mortgage amount you borrowed is diminished significantly especially if you took a large capital. With biweekly mortgage payments you make 26 half-payments a year which equates to 13 total payments in a year.

The difference between your home price and down payment. It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. 360 original 30-year term Interest Rate Annual.

One option to consider is a biweekly every two week payment plan. If your current rate on a 30-year fixed loan is 4000 would you like to see if you can get it lower. Monthly payments start on.

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023. Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. The mortgage amortization schedule shows how much in principal and interest is paid over time.

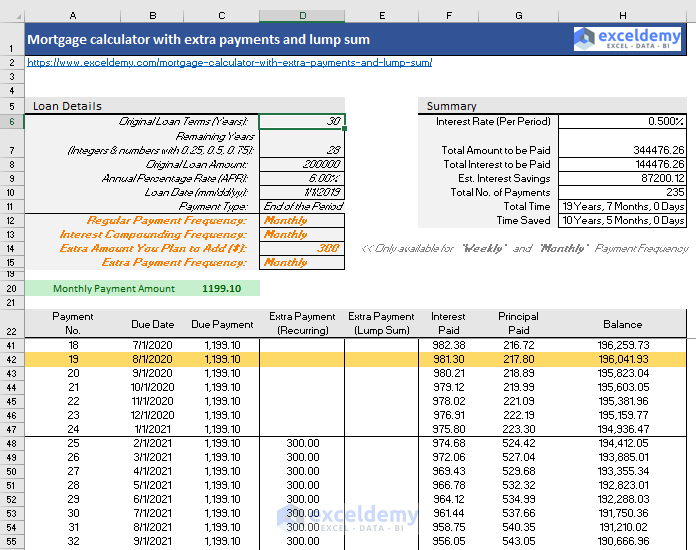

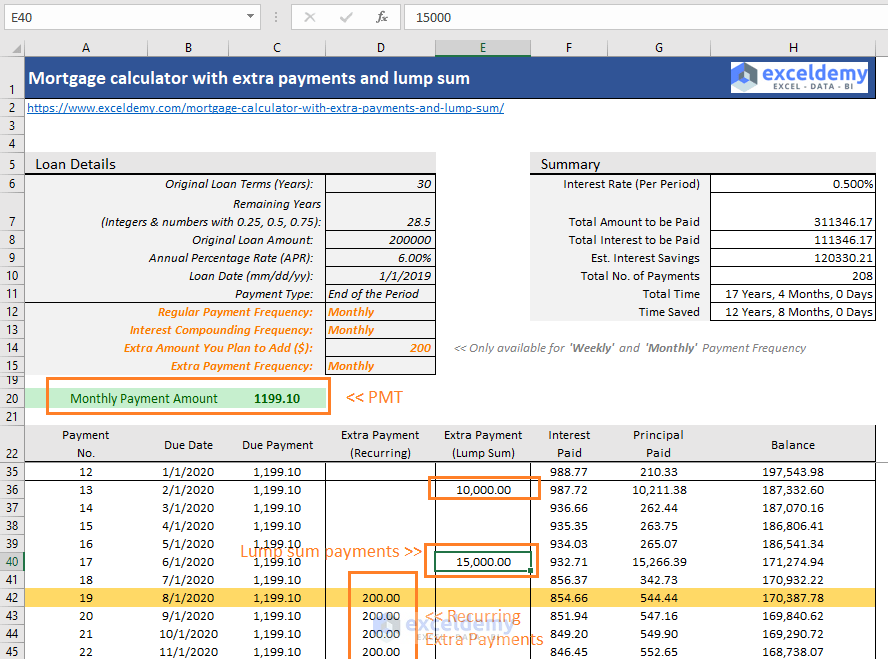

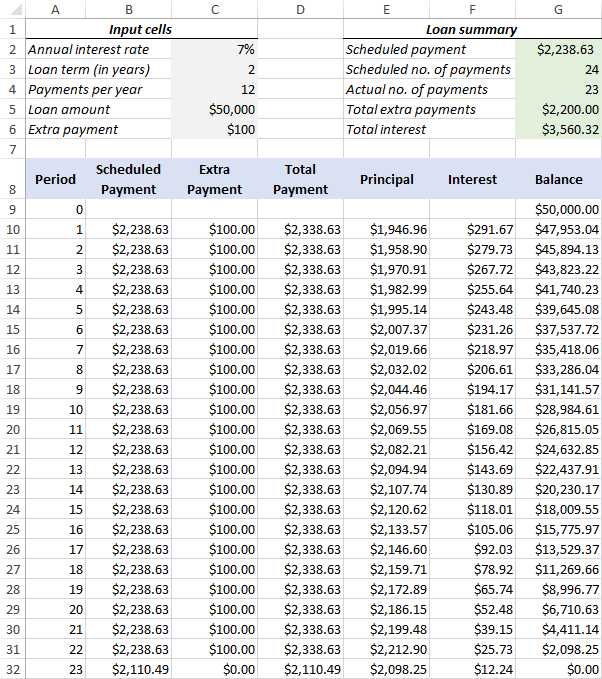

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

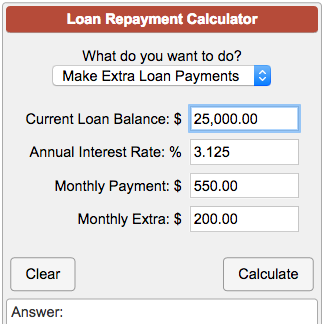

Loan Repayment Calculator

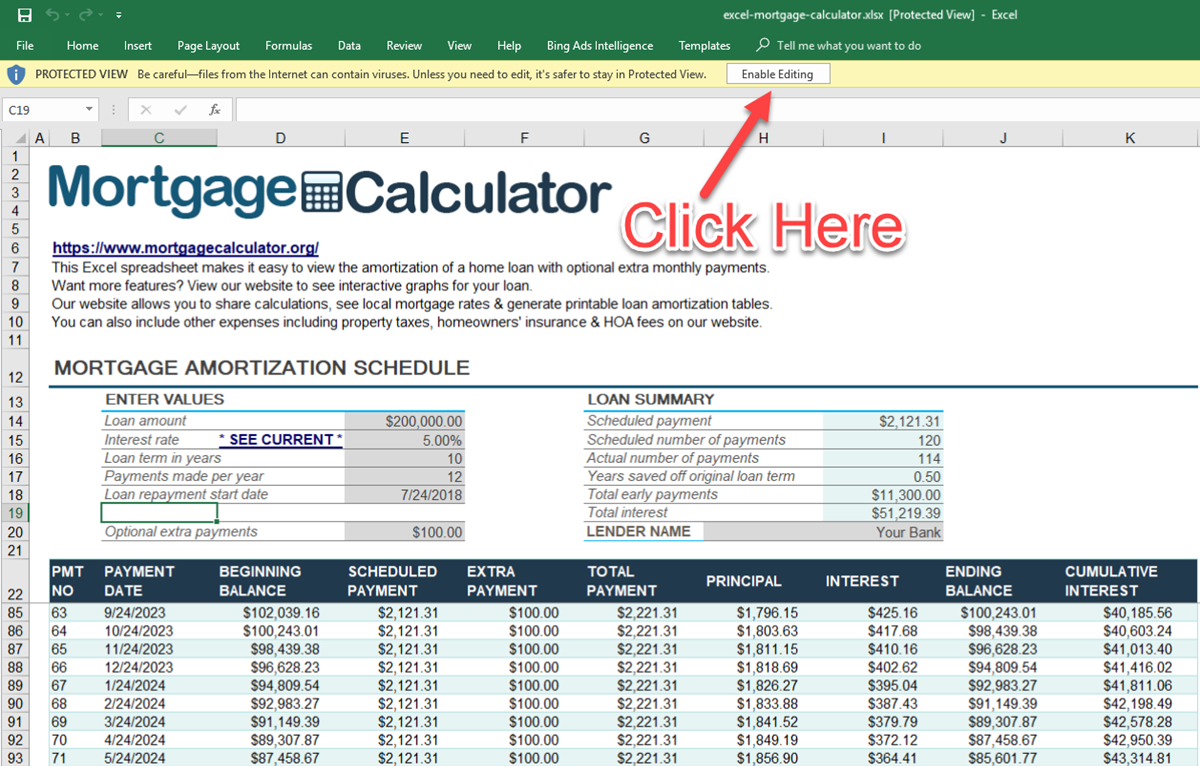

Extra Payment Mortgage Calculator For Excel

Extra Payment Calculator Is It The Right Thing To Do

Extra Payment Calculator Is It The Right Thing To Do

Free Interest Only Loan Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Car Loan Calculator

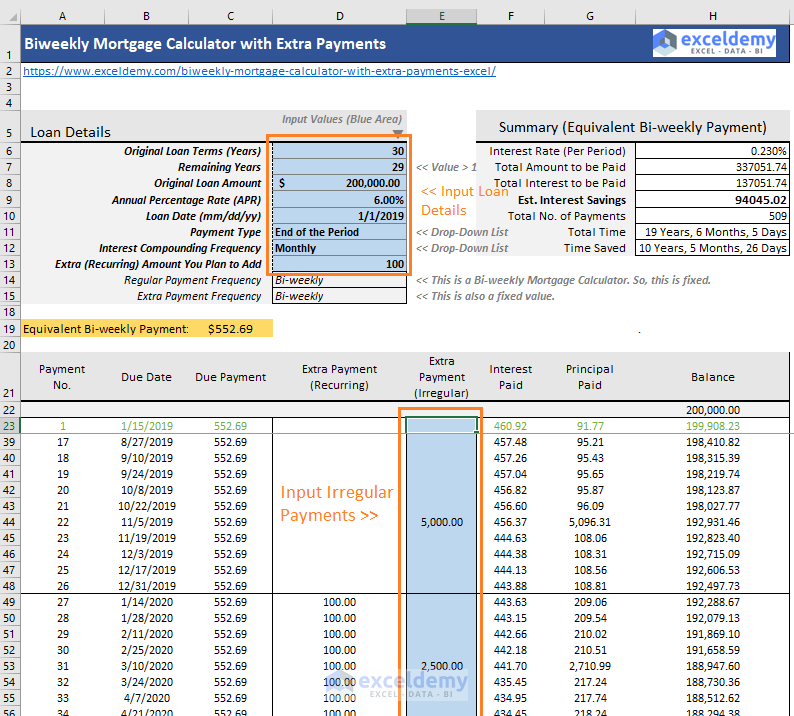

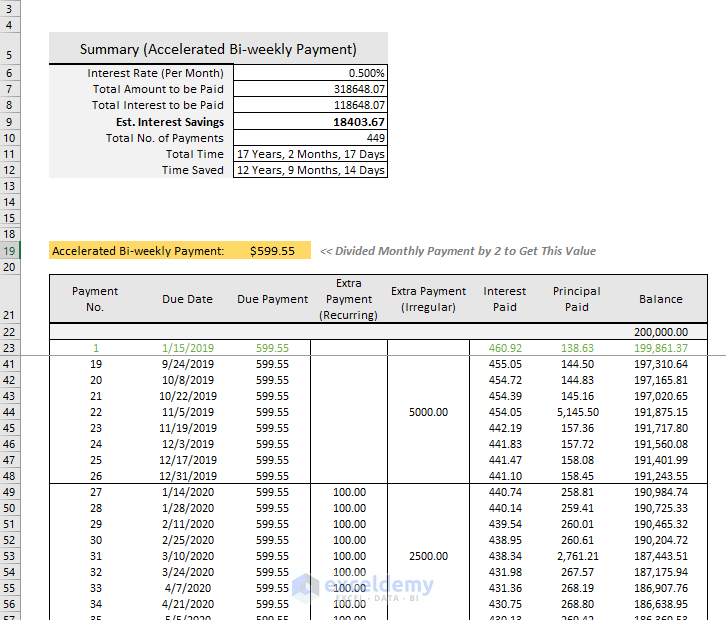

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

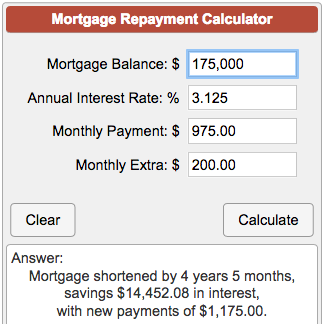

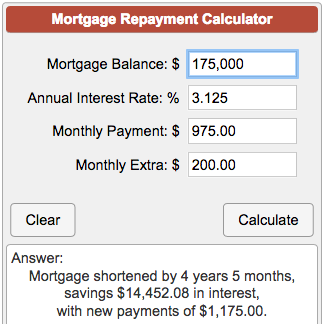

Mortgage With Extra Payments Calculator

Mortgage Repayment Calculator

Extra Payment Calculator Is It The Right Thing To Do

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template